Understanding the Basics of Budgeting

Budgeting is the process of creating a plan to manage your finances. It involves tracking your income and expenses, setting financial goals, and making a plan to achieve those goals. For beginners, it’s important to understand the basics of budgeting before diving into more advanced budgeting techniques.

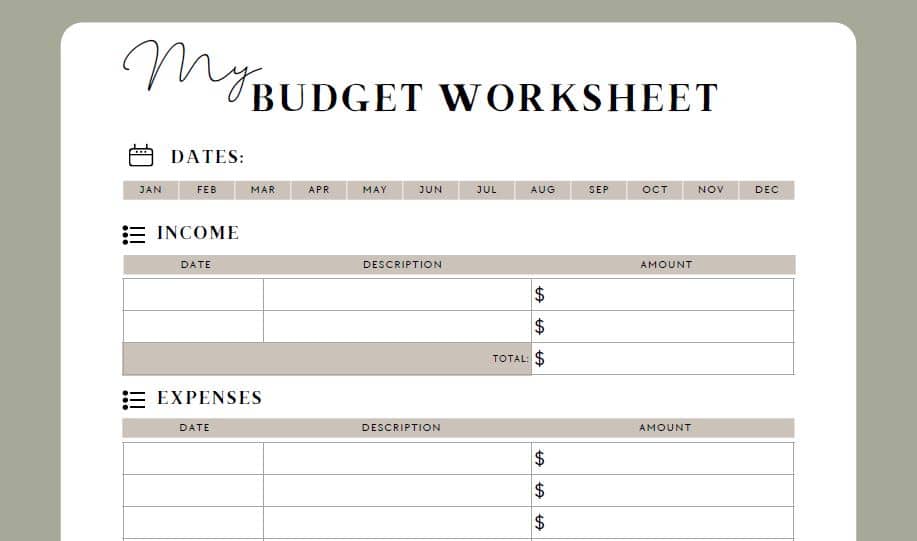

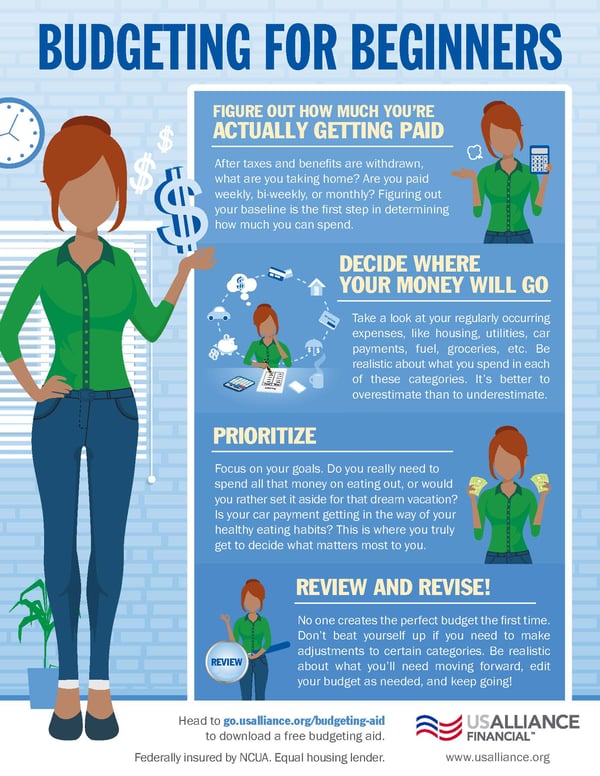

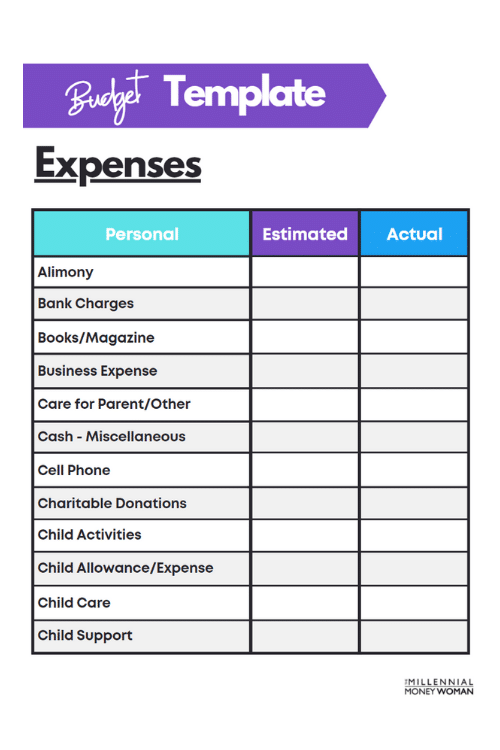

To start, you’ll want to track your income sources, which can include your salary, side hustle earnings, or investment income. Next, you’ll want to track your expenses, which can include bills, groceries, entertainment, and other spending categories. By tracking both your income and expenses, you can get a clear picture of your financial situation.

Once you have a good understanding of your income and expenses, you can start setting financial goals. This could include saving for a vacation, paying off debt, or building an emergency fund. By setting specific, measurable goals, you can stay motivated and focused on your budgeting journey.

Finally, you’ll want to make a plan to achieve your financial goals. This could involve cutting back on unnecessary expenses, finding ways to increase your income, or creating a savings plan. By creating a budget and sticking to it, you can take control of your finances and work towards achieving your financial goals.

Creating a Budget That Works for You

When creating a budget, it’s important to find a budgeting method that works for you. There are many different budgeting methods to choose from, including the 50/30/20 rule, zero-based budgeting, and envelope budgeting. Experiment with different methods to find one that aligns with your financial goals and lifestyle.

One popular budgeting method is the 50/30/20 rule, which involves allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. This method can help you prioritize your spending and ensure that you’re saving for the future while still enjoying your money.

Another popular budgeting method is zero-based budgeting, where every dollar of your income is allocated to a specific category, such as bills, groceries, or entertainment. This method can help you track your spending more closely and ensure that you’re not overspending in any category.

Envelope budgeting is another effective budgeting method, where you allocate cash to different envelopes for different spending categories. Once the cash in an envelope is gone, you can’t spend any more money in that category until the next budget period. This method can help you stick to your budget and avoid overspending.

Tips for Sticking to Your Budget

Sticking to a budget can be challenging, especially for beginners. However, there are several tips and tricks you can use to help you stay on track with your budgeting goals. One tip is to automate your savings and bill payments, so you don’t have to worry about remembering to make payments each month.

Another tip is to track your spending regularly and adjust your budget as needed. By keeping an eye on your expenses, you can identify any areas where you’re overspending and make adjustments to stay within your budget.

It’s also important to set realistic goals and expectations for your budget. If you’re constantly feeling restricted by your budget, you may be less likely to stick to it long-term. Instead, focus on making small, sustainable changes to your spending habits over time.

Finally, don’t be too hard on yourself if you slip up and overspend in a certain category. Budgeting is a learning process, and it’s okay to make mistakes along the way. The key is to learn from those mistakes and adjust your budget accordingly for the future.

Benefits of Budgeting for Beginners

Budgeting has many benefits for beginners, including helping you gain control of your finances, reduce stress, and work towards achieving your financial goals. By creating a budget, you can see exactly where your money is going and make informed decisions about your spending.

Budgeting can also help you reduce financial stress by giving you a clear plan for managing your money. Knowing that you have a plan in place for your finances can give you peace of mind and reduce anxiety about money.

Additionally, budgeting can help you work towards achieving your financial goals, whether that’s saving for a big purchase, paying off debt, or building an emergency fund. By creating a budget and sticking to it, you can make steady progress towards achieving your goals.

Overall, budgeting is a valuable tool for beginners looking to take control of their finances and work towards a more secure financial future. By creating a budget that aligns with your financial goals and lifestyle, you can set yourself up for success and achieve financial freedom.

Conclusion

In conclusion, budgeting is a valuable tool for beginners looking to take control of their finances and work towards achieving their financial goals. By understanding the basics of budgeting, creating a budget that works for you, and sticking to your budget, you can gain control of your finances and work towards a more secure financial future. Remember to track your income and expenses, set realistic goals, and find a budgeting method that aligns with your financial goals and lifestyle. By following these tips and staying committed to your budget, you can achieve financial freedom and live a more financially secure life.